BTC Price Prediction: Path to $200,000 Amid Current Market Crosscurrents

#BTC

- Technical Support Levels: Bitcoin is testing critical support at $109,700 with MACD indicating underlying bullish momentum despite short-term pressure

- Mixed Market Sentiment: Whale-induced volatility and bearish predictions are countered by strong institutional adoption narratives and political support

- Path to $200,000: Requires 82% appreciation from current levels, dependent on sustained institutional inflows and positive macroeconomic conditions

BTC Price Prediction

Technical Analysis: Bitcoin Faces Key Support Test

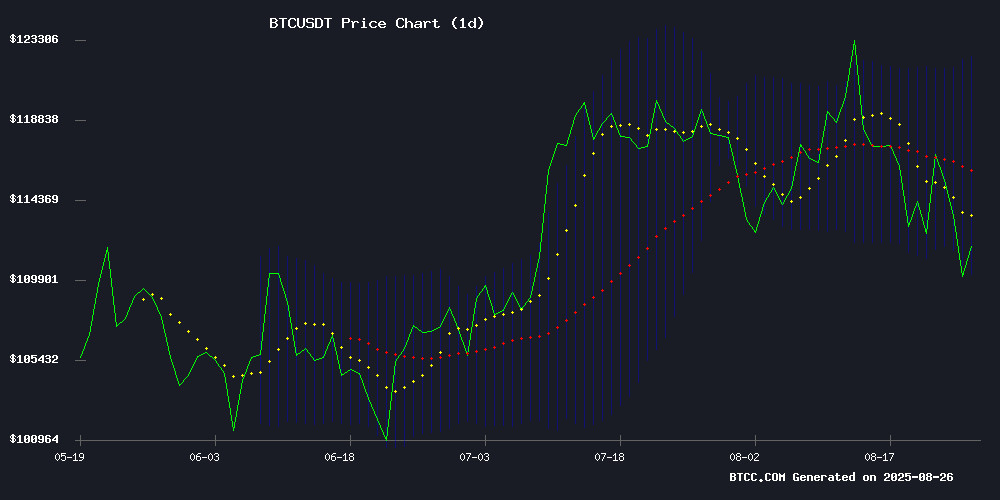

Bitcoin is currently trading at $109,621, sitting below its 20-day moving average of $116,196, which suggests near-term bearish pressure. The MACD indicator shows a positive reading of 2,195.78, significantly above the signal line at 495.95, indicating underlying bullish momentum remains intact. Bitcoin is trading near the lower Bollinger Band at $109,724, which often acts as a support level during corrections.

According to BTCC financial analyst William: 'The current technical setup shows bitcoin testing crucial support levels. While the price has dipped below the 20-day MA, the MACD divergence suggests this may be a healthy pullback rather than a trend reversal. The $109,700 level represents a critical support zone that could determine the next major move.'

Market Sentiment: Mixed Signals Amid Volatility

Current market sentiment reflects a tug-of-war between bearish warnings and bullish institutional adoption narratives. Negative headlines include Peter Schiff's prediction of a major price drop and a recent whale-induced flash crash that liquidated $930 million. However, positive catalysts include Trump's Bitcoin advisor forecasting an 'endless bull run' and growing corporate adoption like Sequans' $200M Bitcoin treasury expansion.

BTCC financial analyst William notes: 'The news FLOW creates a complex sentiment picture. While short-term volatility from whale movements and profit-taking is causing pressure, the underlying institutional adoption story remains strong. Market participants should focus on the structural bullish factors rather than reactive price movements.'

Factors Influencing BTC's Price

Peter Schiff Predicts Major Bitcoin Price Drop Amid Market Volatility

Gold advocate and Bitcoin skeptic Peter Schiff has doubled down on his bearish stance, forecasting a potential plunge to $75,000 for the cryptocurrency. The prediction follows Bitcoin's 13% retreat from recent highs, now hovering near $109,000. Schiff's warning comes despite notable corporate accumulation, including Strategy's recent purchase of 3,081 BTC.

Market dynamics appear fragile despite institutional participation. Schiff contends corporate buying fails to provide meaningful price support, pointing to Strategy's 632,450 BTC holdings as insufficient to prevent further downside. His advice to investors is unequivocal: sell now and prepare to re-enter at substantially lower levels.

The commentary highlights a growing divergence in market sentiment. While some view corporate adoption as bullish, Schiff maintains the real buying opportunity will emerge when major holders begin offloading positions. This perspective challenges the prevailing institutional narrative surrounding Bitcoin's maturation.

Bitcoin Flash Crash Triggered by Whale Dumping 24,000 BTC

Bitcoin's price experienced a violent flash crash Sunday after a single entity offloaded 24,000 BTC worth $2.7 billion. The sell-off slashed $4,000 from Bitcoin's value in minutes, dropping it from $114,700 to $110,700 and erasing $45 billion in market capitalization. Leveraged positions suffered $550 million in liquidations during the turmoil.

The incident underscores Bitcoin's vulnerability to concentrated supply shocks. The whale wallet responsible still holds 152,874 BTC ($17 billion), raising concerns about future market instability. Glassnode data reveals increased whale activity, signaling potential for continued volatility.

Market structure analysis shows Bitcoin's growth faces inherent limitations. Each major holder's exit requires massive capital inflows to absorb selling pressure—a challenge growing more difficult with each cycle. While Bitcoin remains the dominant cryptocurrency, its dependence on early adopters creates systemic fragility.

Chinese Equities and Bitcoin Rally in Sync as Liquidity Drives Global Market Cycle

Chinese equities are re-emerging as a focal point in global markets, mirroring Bitcoin's upward trajectory in a pattern consistent with past cycles. Bloomberg Intelligence analyst Jamie Coutts observes a strong correlation between the Shanghai-Shenzhen CSI 300 index and Bitcoin, with both assets historically peaking simultaneously. This synchronicity suggests macro liquidity conditions are influencing both markets.

China's current fiscal stimulus measures, including a 6% deficit and monetary easing, are fueling the rally. While less aggressive than pandemic-era interventions, these policies contrast with the restraint shown by most G7 economies. The sustained outperformance of equities indicates ongoing liquidity injections, leaving room for further market expansion.

The parallel rise of Bitcoin and Chinese stocks underscores how stimulus measures ripple through global markets. As Coutts notes, this dynamic may continue to benefit both asset classes in the current cycle.

Bitcoin Plummets Below $109K as Whale Dump Triggers $930M Liquidation Event

Bitcoin plunged to a seven-week low during Asian trading hours, shedding $4,000 in hours after a whale unloaded 24,000 BTC ($2.7 billion) in a single transaction. The selloff cascaded across crypto markets, erasing $205 billion in total capitalization—the weakest level since early August.

Leveraged positions bore the brunt as liquidations surpassed $930 million, with 205,000 traders caught in the unwind. Glassnode data confirms all wallet cohorts have shifted to distribution mode, with mid-sized holders (10-100 BTC) leading the exodus. The $105,000 level now emerges as critical support amid Bitcoin's seasonal weakness phase.

Bitcoin Dips Below $110K as Profit-Taking Erases Post-Powell Gains

Bitcoin slumped below $110,000 for the first time in six weeks, dropping 2% to $108,652 amid a broader crypto market pullback. The reversal wipes out last week's gains fueled by Fed Chair Jerome Powell's dovish Jackson Hole remarks, as traders capitalized on the rally to lock in profits.

Technical resistance near $117,000 and shifting rate expectations contributed to the decline. Market depth deteriorated after a whale wallet unloaded 24,000 BTC ($2.6B), triggering derivative liquidations. Risk appetite continues weakening across digital asset markets.

Sequans Raises $200M to Grow Its Bitcoin Treasury

French semiconductor firm Sequans is making a bold bet on Bitcoin, filing to raise $200 million to expand its crypto holdings. The company plans incremental purchases targeting 100,000 BTC by 2030—a move reflecting growing institutional confidence in digital assets as treasury reserves.

With over 3,000 BTC already secured, Sequans aims to boost Bitcoin-per-share metrics while delivering long-term shareholder value. The capital raise positions the Paris-based company among tech firms actively diversifying into cryptocurrency as a core treasury strategy.

Bitcoin September Forecast: 3 Scenarios Traders Must Watch After $109K Crash

Bitcoin's recent plunge to $109,000—triggering nearly $1 billion in liquidations—has left the market divided on its next move. Analyst Altcoin Sherpa outlines three critical scenarios for September, each carrying distinct implications for traders.

Scenario one anticipates a historically weak September, with Bitcoin potentially languishing near $100,000. Past data shows 8 of the last 12 Septembers closed negative, averaging a 3.6% decline. Yet a Fed rate cut could defy seasonal trends, propelling prices above $115,000.

The second scenario envisions a rapid rebound fueled by renewed confidence in Fed dovishness and fresh institutional products. Such a rally risks forming a speculative blow-off top, setting the stage for a violent correction.

Top Crypto Presales 2025 — Analysts Highlight Hidden Gems

Crypto presales are emerging as a focal point for investors seeking high-growth opportunities in a gradually recovering market. Utility-driven platforms and community-centric tokens dominate the 2025 presale landscape, with projects like Remittix and Bitcoin Hyper attracting significant capital inflows.

Remittix has secured $20 million for its PayFi solution targeting cross-border payments, while Bitcoin Hyper's $11 million Layer-2 Bitcoin scaling proposition mirrors Ethereum's early DeFi trajectory. These presales represent a broader shift toward infrastructure projects with tangible use cases.

Trump’s Bitcoin Advisor Predicts Endless Bull Run Amid Institutional Adoption

David Bailey, CEO of Bitcoin Magazine and advisor to former US President Donald Trump, asserts that Bitcoin will no longer face bear markets. His confidence stems from growing institutional adoption, with sovereign nations, banks, and insurers increasingly holding BTC. "The process has already begun," Bailey declared, estimating that less than 0.01% of the total addressable market has been captured.

Contrasting views emerge from analysts warning of cyclical downturns. Ryan McMillin of Merkle Tree Capital draws parallels to gold's post-ETF trajectory, suggesting Bitcoin could mirror its eight-year bull run after financialization. The debate centers on whether institutional involvement fundamentally alters Bitcoin's market cycles or merely delays inevitable corrections.

Will BTC Price Hit 200000?

Based on current technical indicators and market sentiment, reaching $200,000 remains a plausible but challenging target for Bitcoin. The current price of $109,621 would require approximately an 82% increase from current levels.

| Metric | Current Value | Required for $200K | Probability Assessment |

|---|---|---|---|

| Price | $109,621 | +82% | Medium-Term Possible |

| 20-Day MA Position | Below Average | Sustain Above | Needs Improvement |

| MACD Momentum | Bullish Divergence | Maintain Strength | Supportive |

| Market Sentiment | Mixed | Bullish Consensus | Developing |

BTCC financial analyst William suggests: 'While $200,000 is achievable, it requires sustained institutional adoption and a resolution of current volatility. The technical foundation exists, but market sentiment needs to shift from reactive to consistently bullish. Key factors include continued institutional inflows, regulatory clarity, and macroeconomic conditions supporting risk assets.'